Ready to use legal template

Work on without any hassle

Chinese-English translation

Ready to use legal template

Work on without any hassle

Chinese-English translation

Home › Accounting › General receipt

Learn more about General Receipt in China

A General Receipt Form is an official document that acknowledges the receipt of payment, goods, or services between two parties. It serves as proof of transaction, ensuring transparency and accountability in business and financial dealings. In China, properly issued receipts are crucial for tax compliance, accounting records, and legal protection, especially for businesses, freelancers, and service providers. A well-structured General Receipt includes details such as the payer and recipient’s information, transaction date, amount, and description of the payment. It helps prevent disputes and ensures compliance with Chinese financial regulations. Whether used for commercial transactions, reimbursements, or service fees, having a legally sound receipt is essential. Download our General Receipt Form, professionally drafted by lawyers, fully compliant with Chinese regulations, and available in English and Mandarin. The template is easy to edit in Word format, making documentation quick and hassle-free.

Table of contents

-

What is a General Receipt in China?

-

What is included in this General Receipt Form?

-

Is a General Receipt legally required for business transactions?

-

How do I issue a General Receipt for goods or services?

-

What is the difference between a General Receipt and a Fapiao?

-

Can a Receipt be used as proof of payment for tax purposes?

-

Are electronic General Receipts valid under Chinese law?

-

How long should businesses keep copies of General Receipts?

-

Can a General Receipt be issued for international transactions?

What is a General Receipt in China?

In China, a General Receipt serves as an official document that acknowledges the receipt of money, goods, or services. It provides a clear written record of a transaction, detailing the amount paid or goods exchanged, along with relevant information such as the date and the parties involved. Receipts are crucial for businesses and individuals alike, as they help maintain transparency in financial transactions. They also play a key role in accounting, ensuring that proper records are kept for tax purposes. Receipts are necessary for both the buyer and the seller, offering legal protection in case of disputes regarding payments or goods. By documenting a transaction in a standardized format, receipts serve as proof of exchange, which is essential for auditing, tax filings, and verifying compliance with Chinese tax laws. Businesses are required to provide receipts upon request to customers, helping foster trust and ensuring smooth business operations.

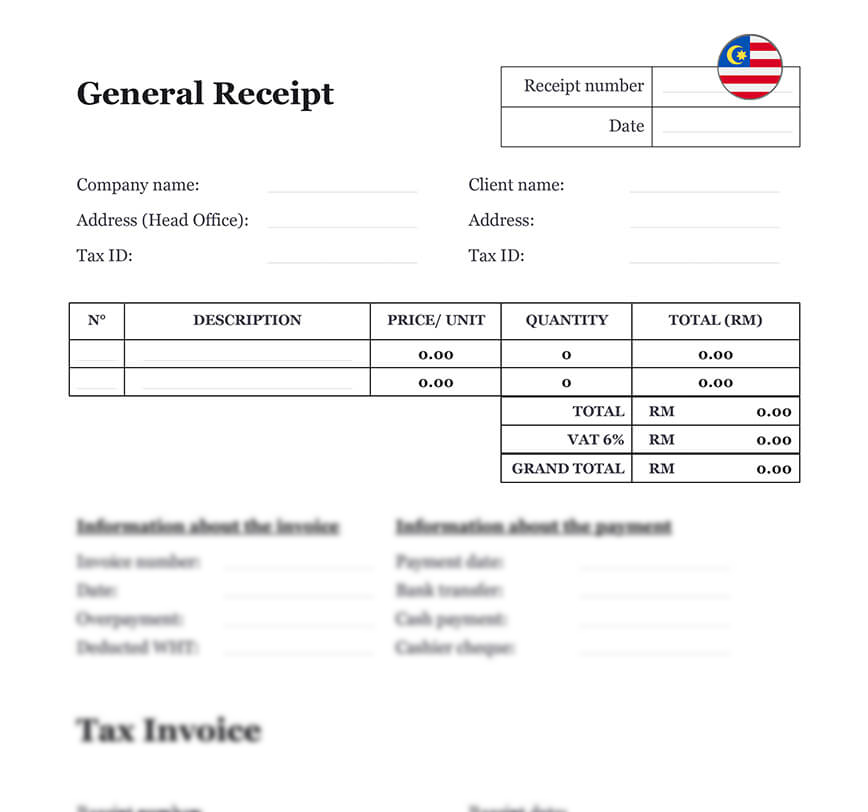

What is included in this General Receipt Form?

A well-drafted General Receipt Form contains several key elements that ensure the accuracy and legality of the transaction. The key components include:

| ➤ Receipt Details: Includes a unique receipt number and issuance date for official record-keeping and tax compliance. The receipt number helps businesses and authorities track transactions and reconcile financial records. |

| ➤ Company and Client Information: Records the full legal name, address, and tax identification numbers (TIN) of both the issuing company and the recipient. This ensures proper documentation for accounting and tax purposes. |

| ➤ Transaction Breakdown: Lists the description of goods or services provided, including the unit price, quantity, and total amount. Provides transparency for both parties to verify transaction details. |

| ➤ Tax and Total Calculation: Includes the applicable VAT (Value-Added Tax) and the grand total to comply with China’s tax regulations, ensuring the correct tax rate is applied. |

| ➤ Invoice Reference: If linked to an invoice, this section records the invoice number and date for accurate bookkeeping and reconciliation. |

| ➤ Payment Details: Specifies the method of payment (bank transfer, cash, or cashier’s check) along with the payment date, ensuring proper tracking. |

| ➤ Withholding Tax (WHT) and Overpayments: Records any tax deductions (such as withholding tax) or overpayments that may apply, ensuring compliance with China’s corporate tax policies. |

| ➤ Official Stamp and Signature: In China, business documents require the company’s official stamp ("chop") and an authorized representative's signature for legal validity. |

| ➤ Receipt Validation: Confirms that the receipt is valid under Chinese regulations, serving as proof of transaction for accounting and tax purposes. |

Is a General Receipt legally required for business transactions?

1. Issuing Receipts in China

In China, issuing receipts is a common and legally required practice for businesses. A General Receipt acts as proof of payment or the exchange of goods and is essential for both tax reporting and accounting purposes. Businesses are obligated to provide receipts in many transactions to ensure proper documentation for financial and tax obligations. Failure to issue receipts can lead to complications during tax audits or disputes over transactions.

2. Requirements for Receipts Based on Transaction Type

While receipts are mandatory for larger transactions or business-related exchanges, the requirement may differ for smaller transactions. In certain cases, such as with smaller amounts, an official receipt may not be required, but businesses are still encouraged to issue them to maintain clear records. Proper receipt issuance helps businesses comply with tax regulations and avoid potential legal issues. For more detailed information, you can refer to the Implementation Rules for the Administrative Measures of the People’s Republic of China for Tax Control.

How do I issue a General Receipt for goods or services?

1. Issuing a General Receipt in China

To issue a General Receipt, businesses must ensure that all relevant transaction details are accurately recorded. This includes verifying the transaction amount, payment method, and any necessary tax information. The receipt should clearly state the company’s legal details, such as its full name, address, and tax identification number, as well as the recipient’s information.

2. Compliance and Validation

Once all information is gathered, the receipt can be generated using a standardized template that aligns with Chinese tax regulations. Depending on the nature of the transaction, the receipt may require the company’s official stamp (chop) and a signature from an authorized representative to be considered legally valid. This ensures that the receipt meets financial and tax compliance standards and can be used for official purposes. You can find more details on the requirements for issuing receipts in China and related tax regulations on the official Chinese State Taxation Administration.

- Remarks:

Receipts must meet Chinese tax regulations to be valid. Incomplete or unauthorized receipts may not be legally accepted in disputes or audits.

What is the difference between a General Receipt and a Fapiao?

1. Fapiao vs. General Receipt in China

In China, both Fapiao and General Receipts serve to document transactions, but they have distinct functions. A Fapiao is a government-issued, official receipt that serves as a formal tax invoice. It is crucial for business-related transactions and is often required to claim tax deductions or refunds. The Fapiao plays a vital role in the Chinese tax system, helping ensure compliance with tax laws. Businesses must issue a Fapiao for most transactions, especially those that involve large sums or are subject to VAT.

2. General Receipt

On the other hand, a General Receipt is typically issued by businesses and is used for non-taxable transactions or transactions where a Fapiao is not required. This type of receipt is common for service fees, small purchases, or personal transactions that do not involve tax deductions. While the General Receipt serves as proof of payment, it does not have the same tax-related functionality as a Fapiao and is not used for claiming tax refunds or deductions.

🔗 A General Receipt serves as proof of transaction, much like an invoice, but it is typically used for non-taxable transactions. An invoice, however, is an official document crucial for tax reporting and may be required for larger business transactions

Can a Receipt be used as proof of payment for tax purposes?

1. General Receipt and Its Role in Tax Reporting

In China, a General Receipt can serve as proof of payment for tax purposes, provided it meets the required financial regulations. It includes essential details such as the transaction amount, tax calculations, and payment method, which can be referenced for tax reporting and audits. While it is useful for general documentation, businesses should ensure that receipts are issued in compliance with the relevant laws to avoid potential issues during audits.

2. Fapiao: The Official Tax Document

For more formal tax deductions or refunds, businesses are generally required to issue a Fapiao, which is recognized as the official tax document in China. The Fapiao provides a higher level of legal recognition than a General Receipt and is essential for claiming VAT deductions, among other tax-related processes. It is particularly important for businesses engaging in larger transactions, as it is necessary for official tax filings.

Are electronic General Receipts valid under Chinese law?

| ➤ Legality of Electronic General Receipts in China: In China, electronic General Receipts are legally valid as long as they meet the required legal standards. These digital receipts must include all necessary components, such as company and client information, transaction details, and applicable taxes, similar to traditional paper receipts. As long as they are authenticated and provide verifiable proof of the transaction, electronic receipts can be issued via email, online systems, or other digital means. |

| ➤ Transition to Digital Receipts: Many businesses are shifting towards digital receipts due to their convenience and efficiency. However, it is essential for companies to ensure that electronic receipts comply with China’s tax and accounting regulations. This ensures that they remain legally valid and can be used for tax reporting and audits without issues. |

How long should businesses keep copies of General Receipts?

1. Legal Requirement for Keeping Receipts in China

In China, businesses must retain copies of all receipts and financial documents for at least five years. This is in accordance with regulations from the State Administration of Taxation, which mandates the retention period to facilitate tax audits and ensure compliance with financial laws. During this time, businesses are expected to store all receipts, invoices, and supporting documents related to transactions to avoid legal complications.

2. Importance of Document Organization

To ensure smooth access during audits or in the event of disputes, it is crucial for businesses to organize receipts and financial documents systematically. Keeping records well-organized not only helps during tax filings but also ensures businesses can efficiently resolve any issues related to financial transactions. A well-maintained filing system allows businesses to comply with Chinese tax laws while keeping financial documentation readily accessible.

3. Compliance and Risk Management

Failing to retain documents for the required five years can lead to significant penalties for businesses. These penalties may include fines, issues with tax deductions, or challenges during tax audits. Therefore, maintaining proper records is not only a legal obligation but also an essential aspect of risk management for businesses operating in China. For further guidance on tax compliance and documentation retention, businesses can consult the official guidelines from China’s State Administration of Taxation.

- Remarks:

Businesses must retain all receipts for at least five years to comply with Chinese tax laws. Failure to do so may result in penalties during audits.

Can a General Receipt be issued for international transactions?

1. Issuing General Receipts for International Transactions

Yes, a General Receipt can be issued for international transactions, as long as it adheres to Chinese regulations. For these transactions, the receipt must include all standard details such as the company and client information, transaction breakdown, tax calculation, and payment details. It is crucial that the receipt also accounts for currency exchange rates and reflects the total transaction amount in the relevant currency.

2. Compliance with Chinese and International Laws

In addition to meeting Chinese tax laws, businesses must ensure that the transaction complies with international regulations governing cross-border payments. This may involve understanding the tax treaties between China and the other country, ensuring proper documentation of foreign exchange transactions, and complying with any other relevant legal frameworks. By doing so, businesses can avoid legal complications and ensure their transactions are transparent and valid for tax purposes.

Conclusion: Why does a General Receipt Form matter in China?

The General Receipt Form plays a crucial role in ensuring transparency and compliance in business transactions in China. Whether you are issuing receipts for goods, services, or payments, this document ensures that all parties have a clear and legally compliant record of the transaction. By including essential details such as company information, payment breakdown, tax calculations, and official validations, a General Receipt helps businesses maintain proper accounting records and comply with Chinese tax regulations. In a rapidly digitalizing business environment, both paper and electronic receipts have their place, as long as they adhere to legal requirements. By understanding and using the General Receipt Form correctly, businesses can avoid disputes, maintain compliance, and streamline their financial operations.

General ReceiptTemplate (.docx)

Easy and quick to customize

310 client reviews (4.8/5) ⭐⭐⭐⭐⭐

Share information

Why Themis Partner ?

Make documents forhundreds of purposes

Hundreds of documents

Instant access to our entire library of documents for China.

24/7 legal support

Free legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

Legal and Reliable

Documents written by lawyers that you can use with confidence.