Ready to use legal template

Work on without any hassle

Chinese-English translation

Ready to use legal template

Work on without any hassle

Chinese-English translation

Home › Accounting › Invoice

Learn more about Invoice in China

An Invoice Form is an official document issued by a seller to a buyer, detailing the products or services provided, their prices, applicable taxes, and payment terms. It serves as a formal request for payment and a critical record for accounting, taxation, and legal compliance. In China, invoices commonly referred to as fapiao (发票) are essential for tax reporting and business transactions, ensuring transparency and regulatory adherence. Whether used for domestic or international trade, a properly structured invoice helps businesses maintain accurate financial records, comply with VAT and corporate tax requirements, and avoid disputes. Our Invoice Form is professionally designed to meet Chinese business standards, providing clarity and ease of use. Download our editable Invoice Form in Word format, available in English and Mandarin, to streamline your invoicing process while ensuring compliance with Chinese regulations.

Table of contents

-

What is an Invoice Form in China?

-

What is included in this Invoice Form?

-

Who is required to issue an Invoice in China?

-

What is a fapiao and how does it differ from a regular Invoice?

-

Can an Invoice be issued electronically in China?

-

What are the VAT rates applicable to Invoices in China?

-

How long should businesses keep Invoices for tax purposes?

-

What is the process for claiming VAT refunds using an Invoice?

-

What are the penalties for issuing an incorrect Invoice in China?

What is an Invoice Form in China?

An Invoice Form is an official document issued by a seller to a buyer, requesting payment for goods or services provided. It serves as proof of a commercial transaction and is essential for accounting, taxation, and legal compliance. In China, invoices are particularly important for Value-Added Tax (VAT) reporting and corporate tax filings. Businesses must issue invoices that meet specific formatting and content requirements to ensure compliance with local laws. There are different types of invoices in China, including general invoices (普通发票) and special VAT invoices (增值税专用发票). Special VAT invoices are primarily used for tax deduction purposes, whereas general invoices are used for non-tax-deductible transactions.

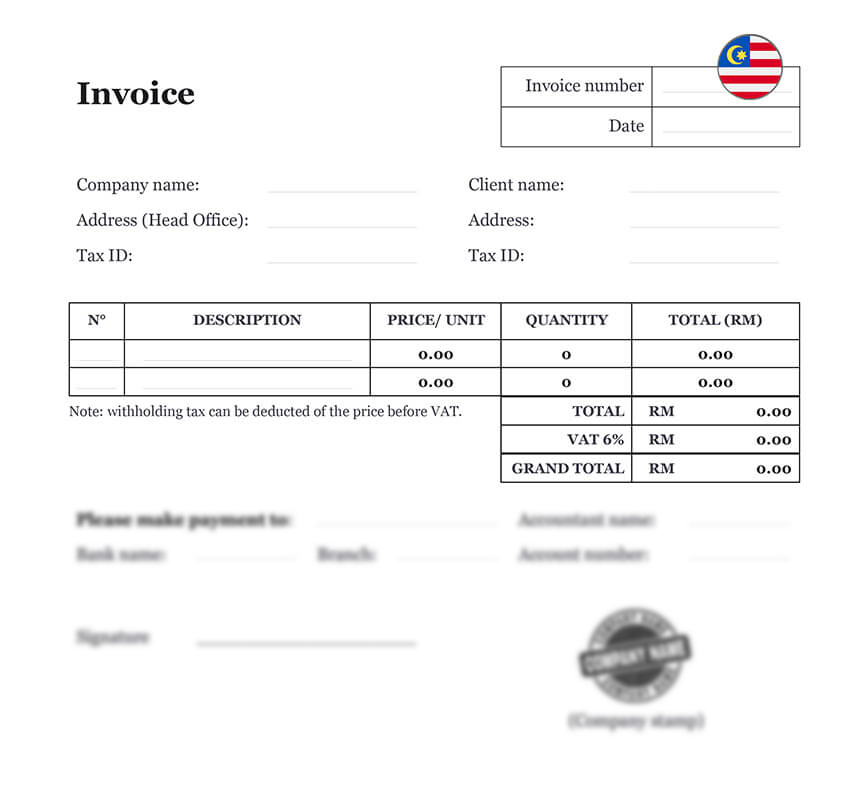

What is included in this Invoice Form?

Our Invoice Form is structured to comply with Chinese regulations and includes the following key clauses:

| ➤ Invoice Details: Each invoice contains a unique invoice number and date of issuance, which are essential for tracking transactions and maintaining tax compliance. The numbering system must follow sequential order to prevent fraud and discrepancies in accounting records. |

| ➤ Company & Client Information: The invoice lists the full legal names, registered addresses, and tax identification numbers (Unified Social Credit Codes) of both the issuing company and the recipient. This ensures proper documentation for tax reporting and regulatory compliance. |

| ➤ Description of Goods/Services: A clear breakdown of the products or services provided is included, specifying unit prices, quantities, and total amounts for each item. This level of detail prevents disputes and ensures transparency in financial transactions. |

| ➤ Total Amount Before Tax: The invoice displays the subtotal before applying taxes, helping both parties understand the base cost of the transaction. |

| ➤ Withholding Tax & VAT: Depending on the nature of the transaction, the invoice specifies whether withholding tax (预提所得税) applies before VAT calculation. It also includes the applicable VAT rate and amount, ensuring full compliance with China’s tax laws. |

| ➤ Grand Total: The invoice clearly states the final payable amount, including all taxes and additional charges. This figure aligns with official fapiao requirements, ensuring consistency with tax declarations. |

| ➤ Payment Instructions: The invoice includes bank details, branch information, and the account number where the payment should be remitted. This section helps streamline payment processing and prevents delays. |

| ➤ Accountant & Authorized Signatory: To validate the document, the invoice identifies the responsible accountant and includes the signature of an authorized representative from the issuing company. |

| ➤ Company Stamp (Chop): In China, a company’s official seal (公章) is mandatory for an invoice to be legally recognized. Without this seal, the invoice may be considered invalid. |

| ➤ Additional Notes: This section allows space for important remarks, such as payment terms, special discounts, or deductions, if applicable. |

Who is required to issue an Invoice in China?

1. Invoice Requirements in China

All businesses selling goods or providing services in China must issue invoices, including companies, freelancers, and service providers. The type of invoice depends on the taxpayer status: General VAT taxpayers must issue special VAT invoices, while Small-Scale VAT taxpayers and non-VAT-registered businesses issue general invoices (fapiao). Proper invoice issuance ensures tax compliance and transparency in business transactions.

2. Compliance and Penalties

Foreign businesses operating in China must also adhere to local invoice regulations. Failure to issue proper invoices can result in tax penalties, fines, or legal disputes with tax authorities. Companies should ensure they follow correct invoicing procedures to avoid financial or legal risks.For official guidance on invoicing rules in China, visit the State Taxation Administration of China.

What is a fapiao and how does it differ from a regular Invoice?

1. What is a Fapiao?

A fapiao (发票) is an official, government-regulated invoice issued by businesses in China under the supervision of the State Tax Administration (STA). Unlike regular invoices, which are used primarily for record-keeping, fapiao serve as legal proof of a transaction for tax reporting and compliance purposes. Every business operating in China is required to issue fapiao for taxable transactions, ensuring transparency and proper tax collection. The fapiao system plays a crucial role in China’s tax framework, helping authorities monitor business activities and prevent tax evasion.

2. Types of Fapiao

There are two main types of fapiao: special VAT fapiao and general VAT fapiao. Special VAT fapiao are primarily used for business-to-business (B2B) transactions and allow buyers to claim value-added tax (VAT) deductions. This makes them essential for companies that need to offset input taxes. On the other hand, general VAT fapiao are issued for transactions that do not qualify for VAT deductions, such as retail sales and consumer purchases. The type of fapiao issued depends on the nature of the transaction and whether tax deductions are applicable.

3. Importance of Fapiao in Business

Fapiao are crucial for both businesses and individuals, as they serve as proof of expenditure, facilitate tax compliance, and are often required for reimbursements. Companies must ensure proper fapiao issuance and management to avoid tax penalties and maintain compliance with Chinese tax regulations. Understanding how to request and verify a fapiao is essential for anyone conducting business in China.

🔗 A general receipt is a simple acknowledgment of payment made for goods or services, often used in place of an invoice for smaller transactions. It provides proof of the exchange and is important for record-keeping and basic financial documentation

Can an Invoice be issued electronically in China?

1. Acceptance of Electronic Invoices in China

Yes, electronic invoices (电子发票) are widely accepted in China, as the government has promoted digital invoicing to enhance tax compliance and efficiency. Businesses use the Golden Tax System (金税系统) to issue e-fapiao, allowing real-time tax reporting and reducing the risks of tax fraud. Electronic invoices are legally recognized and can be used for various transactions, including reimbursements and accounting purposes.

2. ICompliance Requirements for E-Fapiao

To be valid, electronic invoices must comply with the regulations set by the State Taxation Administration (STA). They must include a unique invoice code, be digitally signed, and be stored securely for tax auditing purposes. Businesses and consumers should verify the authenticity of e-fapiao through the official STA platform.

- Remarks:

Electronic invoices must comply with State Taxation Administration requirements. Businesses should ensure that all digital invoices are issued through the Golden Tax System and meet legal standards to avoid penalties.

What are the VAT rates applicable to Invoices in China?

In China, VAT rates vary depending on the type of goods or services provided. The following table outlines the applicable VAT rates for different industries:

| Category | VAT Rate |

| General goods & manufacturing | 13% |

| Transportation, construction & rental | 9% |

| Professional, consulting & tech services | 6% |

| Small-scale taxpayers | 3% (cannot issue special VAT fapiao) |

It is essential for businesses to apply the correct VAT rate to ensure compliance with Chinese tax regulations.

🔗 A payslip is a document issued by employers to employees detailing their earnings, deductions, and net pay for a given period. It is an essential document for both employees and businesses for compliance with labor laws and tax reporting.

How long should businesses keep Invoices for tax purposes?

1. Invoice Retention Requirements in China

According to Chinese tax regulations, businesses must retain invoices for at least 10 years. Proper invoice management is essential for tax audits, financial reporting, and legal compliance. Failure to maintain these records may result in penalties or difficulties during inspections by tax authorities.

2. Digital vs. Physical Storage

Businesses can keep digital copies of invoices as long as they ensure secure storage and easy accessibility for tax authorities. Implementing reliable backup solutions and document management systems is crucial to compliance.

What is the process for claiming VAT refunds using an Invoice?

1. VAT Refund Process in China

To claim a VAT refund in China, businesses must obtain a special VAT fapiao from the seller. This invoice must be registered in the Golden Tax System, which is the central tax control system used by the Chinese tax authorities. Once registered, businesses can submit the VAT invoice along with supporting documents such as contracts and payment receipts to the tax authorities.

2. Ensuring Accurate Documentation

It is crucial for businesses to ensure that all invoices are correct and in compliance with tax regulations. Any errors or discrepancies in the submitted invoices can lead to delays in receiving VAT refunds and potential financial losses. Ensuring accurate record-keeping and proper submission of all required documents will help expedite the refund process and maintain compliance. For further guidance, refer to the State Taxation Administration of China.

What are the penalties for issuing an incorrect Invoice in China?

1. Legal Risks of Incorrect or Fraudulent Invoices in China

Issuing incorrect or fraudulent invoices in China can result in serious legal consequences, including substantial fines, tax audits, and criminal charges. Common violations include issuing fake invoices (虚开发票), incorrectly calculating VAT, and using unauthorized invoice templates. These actions undermine the integrity of financial reporting and tax compliance.

2. Prevention and Compliance

To avoid these risks, businesses must ensure that all invoices comply with the regulations set forth by the State Taxation Administration (STA). Companies should use only authorized invoicing software and ensure their invoices are properly recorded and issued according to official guidelines. By adhering to these standards, businesses can protect themselves from legal and financial repercussions.

- Remarks:

Issuing incorrect or fraudulent invoices, including fake fapiao, VAT miscalculations, or using unauthorized invoice formats, can lead to severe fines, legal action, and possible criminal charges. Always adhere to official invoicing guidelines to avoid legal risks.

Conclusion: Why does an Invoice matter in China?

Invoices are a fundamental part of business transactions and tax compliance in China. Understanding their structure, legal requirements, and best practices helps businesses avoid penalties, maintain financial transparency, and ensure smooth operations. Themis Partner provides a fully compliant, professionally drafted Invoice Form that meets Chinese tax and business regulations. Download the template today in English and Mandarin to streamline your invoicing process with ease and confidence.

Share information

Why Themis Partner ?

Make documents forhundreds of purposes

Hundreds of documents

Instant access to our entire library of documents for China.

24/7 legal support

Free legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

Legal and Reliable

Documents written by lawyers that you can use with confidence.