Ready to use legal template

Work on without any hassle

Chinese-English translation

Ready to use legal template

Work on without any hassle

Chinese-English translation

Home › Accounting › Payslip

Learn more about China Payroll Service

A Payslip Form is an essential document that serves as a detailed record of an employee’s earnings, deductions, and net salary for a specific pay period. In China, employers are required to provide payslips to employees to ensure transparency in salary payments and compliance with local labor laws. Payslips typically include details such as basic salary, overtime pay, tax deductions, social insurance contributions, and any other allowances or bonuses. Providing a payslip is not only a best practice for maintaining accurate financial records but also a legal requirement in many cases, helping to prevent disputes over wages and benefits. Ensuring that payslips are clear and legally compliant is crucial for both employers and employees. Download our easy-to-edit Payslip Form in Word format, available in both English and Mandarin, professionally drafted by our legal experts at Themis Partner.

Table of contents

-

What is a Payslip Form in China?

-

What is included in this Payslip Form?

-

Is it mandatory for employers to provide a Payslip in China?

-

How can employees verify salary calculations using a Payslip?

-

What deductions and contributions are listed on a Chinese Payslip?

-

Can a Payslip be used as proof of income in China?

-

How long should employers keep Payslip records in China?

-

What should I do if my Payslip contains errors or missing information?

-

Is a digital Payslip legally valid in China?

What is a Payslip Form in China?

A payslip form in China is a formal document issued by an employer to an employee after every payroll period. It outlines the employee’s total earnings, deductions, and net salary. It is an essential part of the payroll system and ensures that employees are paid fairly and transparently according to the terms of their employment contract. Payslips help employees verify their earnings and deductions and provide a clear record that can be referred to for future financial planning or when resolving any wage disputes. Under Chinese law, providing a payslip is mandatory to ensure clarity in compensation. It also serves as evidence of the salary paid and any deductions made in compliance with labor regulations, which ensures that both parties are aware of the financial transactions between them.

What is included in this Payslip Form?

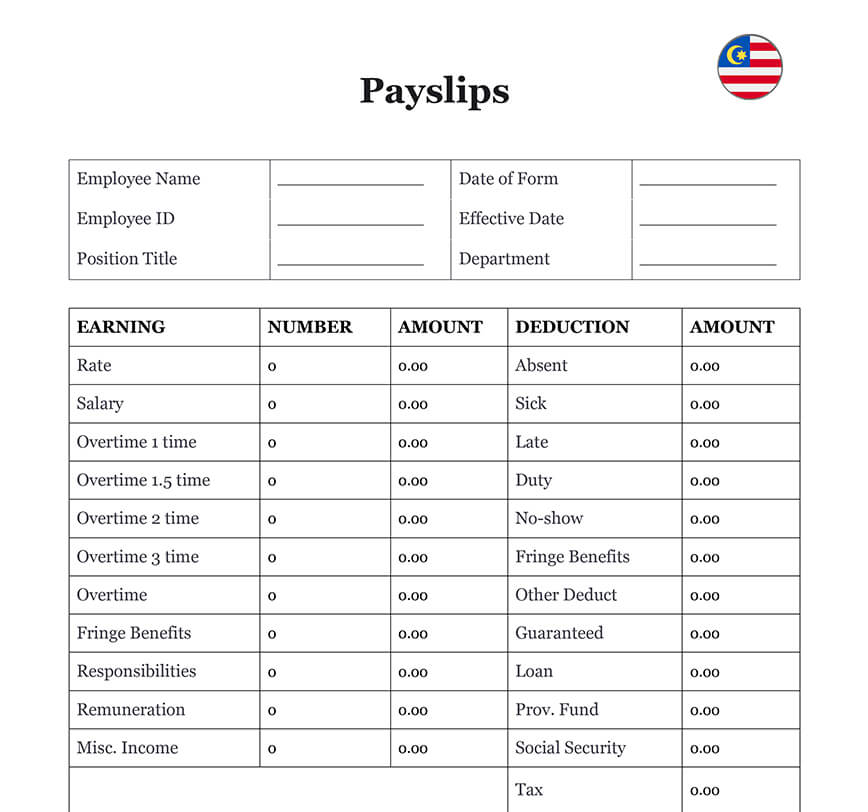

The payslip form contains several key sections to ensure transparency and compliance with Chinese labor laws. Here are the essential components included in the form:

| ➤ Employee Information: This includes the employee’s name, identification number, department, job title, and the effective date of the payslip. |

| ➤ Earnings Breakdown: It lists various components of the employee’s salary. This includes the base salary, overtime pay, bonuses, commissions, and any additional payments that the employee is entitled to, as per Chinese labor laws. |

| ➤ Deductions Breakdown: This section specifies the deductions made from the employee’s salary, including absences, late arrivals, or no-shows. Any penalties imposed by the company are also reflected here. |

| ➤ Statutory Contributions: A breakdown of mandatory deductions such as social insurance (养老保险, 医疗保险, 失业保险) and housing provident fund (公积金), which are required by China’s labor and tax laws. |

| ➤ Tax Withholding: The payslip will display income tax (个人所得税) deductions based on China’s progressive tax system, ensuring compliance with national regulations. |

| ➤ Net Salary Calculation: This section shows the final amount that the employee will take home after all earnings and deductions have been accounted for. |

These details not only provide a clear view of the employee’s compensation but also ensure that the employer complies with legal and regulatory requirements.

Is it mandatory for employers to provide a Payslip in China?

1. Mandatory Payslips for Employers in China

In China, employers are legally obligated to provide payslips to employees. This ensures transparency in the salary distribution process, including a detailed breakdown of earnings, deductions, and other contributions such as taxes and social security. The requirement is not just a good practice but a legal necessity under Chinese labor and tax regulations. Failure to provide payslips can lead to legal consequences for the employer, including fines or disputes over unpaid wages and incorrect deductions.

2. The Role of Payslips in Dispute Resolution

Payslips serve as an important record for both the employee and the employer, detailing the salary paid and any adjustments or deductions made. This documentation is vital in case of disputes regarding wages or deductions, providing clear evidence of the financial transactions between both parties. Employers should ensure that their payroll system is compliant with the law to avoid complications and legal issues. For more information, you can visit the Ministry of Human Resources and Social Security of China.

- Remarks:

Employers must comply with Chinese labor and tax regulations by providing payslips. Non-compliance may result in legal action, including fines or disputes regarding wage discrepancies.

How can employees verify salary calculations using a Payslip?

1. Verifying Salary Calculations on Payslips

Employees can verify their salary calculations by carefully reviewing the payslip, which provides a detailed breakdown of earnings and deductions. The earnings section should list the total amount earned during the pay period, including base salary, overtime pay, bonuses, and allowances. The deductions section will show adjustments such as penalties for absences or late arrivals, as well as statutory deductions for social insurance and taxes.

2. Cross-Checking Deductions for Compliance

Employees can cross-check the deductions for social insurance and taxes against the applicable rates provided by the Chinese government. Social insurance contributions are calculated based on a fixed percentage that varies according to salary brackets, while income tax withholding is based on a progressive tax system. By comparing the earnings and deductions, employees can ensure that their salary is being paid correctly and in full, and in compliance with Chinese labor and tax laws.

What deductions and contributions are listed on a Chinese Payslip?

A payslip in China includes several mandatory deductions, as well as possible additional deductions based on company policies. The following are the most common deductions:

| ➤ Social Insurance: Employers and employees are required to contribute to social insurance schemes, which include pension (养老保险), medical insurance (医疗保险), unemployment insurance (失业保险), and maternity insurance. The rates for these contributions vary depending on the employee’s salary and the city in which they work. |

| ➤ Housing Provident Fund: This is a mandatory savings plan to help employees save for housing-related expenses. Both the employer and employee contribute to this fund, with rates determined by local authorities. |

| ➤ Income Tax: Employees are subject to personal income tax (个人所得税), which is calculated based on a progressive tax system. The tax rate ranges from 3% to 45% depending on the employee’s monthly salary. |

| ➤ Other Deductions: These may include deductions for absences, lateness, penalties, or loans if applicable. |

These mandatory contributions are essential for compliance with Chinese labor laws and ensure that employees have access to necessary benefits like healthcare, pension, and unemployment support.

🔗An Invoice provides a detailed breakdown of the products or services provided and the total amount owed. It is a key document used in business transactions, ensuring clarity and accountability in financial dealings.

Can a Payslip be used as proof of income in China?

1. Payslips as Proof of Income in China

Yes, in China, payslips can be used as valid proof of income. They serve as official records of salary payments, including details on earnings, deductions, and other contributions. This makes them a reliable document when verifying an individual’s income. For instance, employees may present their payslips to banks when applying for loans, credit cards, or mortgages, or to landlords when securing a rental agreement. Since the payslip provides a clear breakdown of an employee’s financial status, it is widely accepted for various financial and legal processes.

2. Importance of Payslips in Financial and Legal Processes

Payslips are essential documents in both personal and professional financial dealings. They offer a transparent record of regular income, allowing individuals to demonstrate their financial reliability. Whether for applying for loans, renting properties, or meeting tax obligations, a payslip ensures credibility and clarity in these processes. This highlights the importance of keeping a well-documented and accurate payroll system, as it helps avoid potential disputes and facilitates smoother transactions in different financial settings;You can also refer to the China Labor Bulletin, which provides detailed resources on labor rights and regulations in China, including issues related to payslips, income verification, and employer obligations under Chinese labor law.

How long should employers keep Payslip records in China?

1. Retention of Payslip Records in China

In China, employers are required to retain payslip records for a minimum of two years after the termination of an employee’s contract. This legal obligation ensures that there is a clear record of an employee’s compensation, which can be referenced in case of disputes related to unpaid wages, tax issues, or other employment-related matters. By maintaining these records, employers help protect themselves from potential legal claims or disputes that may arise in the future.

2. Protecting Employee Privacy

Employers must ensure that these records are securely stored to protect the privacy and confidentiality of the employees. This includes using secure systems for electronic records or locked storage for physical records. Failure to comply with retention and privacy laws can result in legal consequences for the employer.

🔗 A general receipt is typically issued as proof of payment for goods or services rendered. It serves as a record for both the customer and the business to verify that a transaction has been completed.

What should I do if my Payslip contains errors or missing information?

Here’s a table in presenting the actions to take in case of errors on a payslip:

| ➤ Contact HR or Payroll Department: The employee should immediately notify the HR or payroll department to address any errors or missing information on the payslip. |

| ➤ Review Employment Contract and Labor Laws: If the issue persists, the employee should check their employment contract and local labor laws to ensure that the salary and deductions are accurate. |

| ➤ Seek Legal Advice or File a Complaint: If the employer fails to resolve the issue, the employee may seek legal advice or file a complaint with the local labor authorities. |

This table outlines the steps employees can take when they notice discrepancies on their payslip.

Is a digital Payslip legally valid in China?

1. Legality of Digital Payslips in China

payslips. The digital version must contain all necessary information, such as earnings, deductions, and other contributions, ensuring transparency. Employers must store these digital payslips securely and ensure employees can access and review them when needed. The format of digital payslips can include emails, employee portals, or other secure platforms.

2. Employee Consent and Access to Digital Payslips

While digital payslips are legally acceptable, employers must obtain the employee’s consent to receive them electronically. It is essential for employees to ensure that they can access and, if necessary, print their digital payslips. This helps maintain clarity in the employer-employee relationship and ensures that employees have a reliable record of their earnings and deductions.

- Remarks:

Digital payslips are legally valid if they meet regulatory standards. Employers must ensure secure storage and access for employees, and must obtain consent before issuing digital versions.

Conclusion: Why does a Payslip matter in China?

A payslip form in China is an essential document that serves as proof of earnings and deductions. It ensures transparency and compliance with Chinese labor and tax regulations, and provides employees with a clear record of their compensation. Employers must provide accurate and legally compliant payslips to avoid disputes and ensure a smooth relationship with their employees. By understanding the components of a payslip, including earnings, deductions, and statutory contributions, both employers and employees can ensure that the payroll process remains transparent and legally sound.

Share information

Why Themis Partner ?

Make documents forhundreds of purposes

Hundreds of documents

Instant access to our entire library of documents for China.

24/7 legal support

Free legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

Legal and Reliable

Documents written by lawyers that you can use with confidence.